How Can Startup Founders Conduct Effective Market Sizing?

Why is market sizing important for startups?

Market sizing is crucial for startups because:

- Opportunity validation: It helps verify if the market is large enough to support your business.

- Strategic planning: It guides resource allocation and growth strategies.

- Investor attraction: It demonstrates market potential to potential investors.

- Goal setting: It helps in setting realistic revenue and growth targets.

- Competitive analysis: It provides context for understanding your potential market share.

- Product development: It informs decisions about product features and pricing.

- Risk assessment: It helps in evaluating the viability and potential risks of the business.

Accurate market sizing is fundamental to validating your startup’s potential for success.

How can startups accurately calculate their Total Addressable Market (TAM)?

To calculate TAM accurately:

- Define market boundaries: Clearly specify the scope of your market.

- Use top-down approach: Start with industry-wide data and narrow down to your specific market.

- Apply bottom-up method: Estimate potential customers and multiply by average revenue per customer.

- Leverage multiple data sources: Use industry reports, government data, and market research.

- Consider future growth: Factor in market growth projections.

- Validate with experts: Consult industry specialists to verify your estimates.

- Use comparable markets: Look at similar markets in different regions for reference.

Combine multiple approaches to arrive at a well-rounded and defensible TAM estimate.

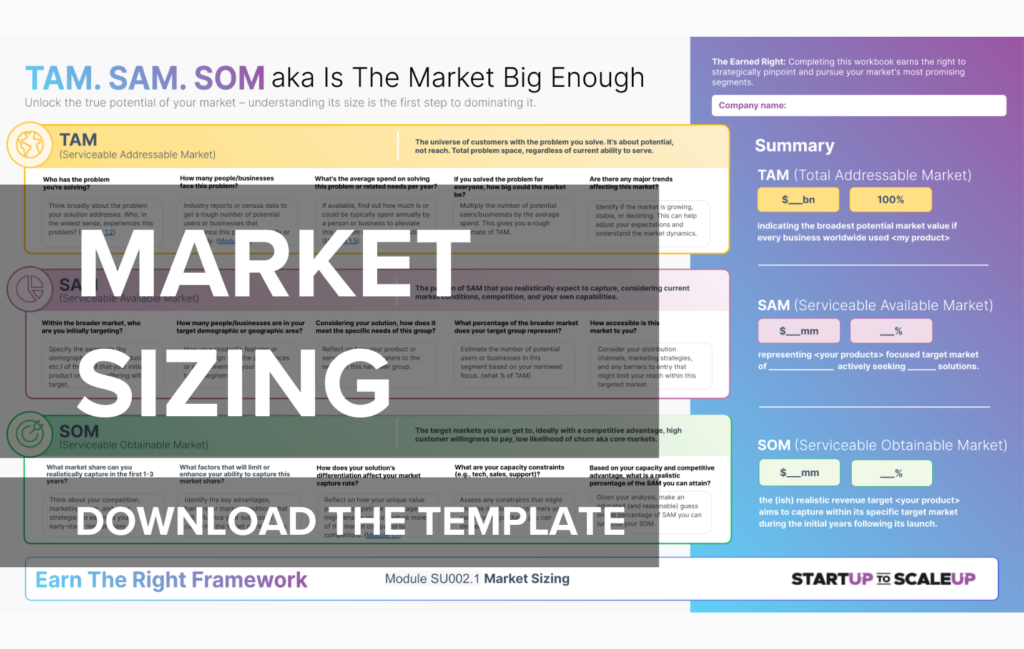

What’s the difference between TAM, SAM, and SOM in market sizing?

TAM, SAM, and SOM represent different levels of market sizing:

- TAM (Total Addressable Market):

- The total market demand for your product or service.

- Represents the maximum potential market if you could serve all possible customers.

- SAM (Serviceable Available Market):

- The portion of TAM that you can realistically target with your current business model and capabilities.

- Considers geographical constraints, product limitations, and target customer segments.

- SOM (Serviceable Obtainable Market):

- The portion of SAM that you can realistically capture in the near term.

- Considers factors like competition, resources, and go-to-market strategy.

Understanding these distinctions helps in setting realistic goals and communicating potential to stakeholders.

How can market sizing help startups attract investors?

Market sizing helps attract investors by:

- Demonstrating opportunity: Showing the potential size of the business opportunity.

- Validating business model: Proving there’s a large enough market to support growth.

- Informing valuation: Providing a basis for estimating potential company value.

- Showing market knowledge: Demonstrating deep understanding of the industry.

- Supporting projections: Backing up revenue and growth projections with data.

- Highlighting growth potential: Illustrating room for expansion and scaling.

- Contextualizing competition: Showing how much market share is realistically attainable.

A well-researched market size analysis can significantly strengthen your pitch to investors.

What common mistakes should founders avoid in market sizing?

Common market sizing mistakes to avoid:

- Overestimating market size: Being overly optimistic about potential market reach.

- Ignoring market segments: Failing to break down the market into relevant segments.

- Using outdated data: Relying on old market information that may no longer be accurate.

- Neglecting competition: Failing to account for existing players in the market.

- Misaligning with product: Including market segments your product doesn’t actually serve.

- Ignoring adoption rates: Assuming 100% market penetration is possible.

- Lack of validation: Not verifying estimates with multiple sources or expert opinions.

Avoid these pitfalls by approaching market sizing with realism and thorough research.

How often should startups reassess their market size estimates?

Startups should reassess market size estimates:

- Annually: Conduct a comprehensive review at least once a year.

- Before funding rounds: Update estimates when preparing for investor pitches.

- When entering new markets: Reassess when expanding to new geographical or product markets.

- After significant market changes: Review when major industry shifts occur.

- During strategic planning: Incorporate updated estimates into annual or quarterly planning sessions.

- When pivoting: Reassess if changing your product or target market significantly.

- As new data becomes available: Update estimates when new industry reports or data sources emerge.

Regular reassessment ensures your market sizing remains accurate and relevant as your startup and the market evolve.

How can startups use market sizing to inform their growth strategy?

Startups can use market sizing to inform growth strategy by:

- Identifying expansion opportunities: Pinpoint underserved segments or geographies within your TAM.

- Prioritizing product development: Focus on features that address the largest market segments.

- Allocating resources: Invest more heavily in areas with the greatest market potential.

- Setting realistic goals: Base growth targets on achievable market share within your SAM.

- Guiding marketing efforts: Focus marketing spend on the most promising market segments.

- Informing pricing strategy: Understand what different market segments are willing to pay.

- Planning funding needs: Estimate capital requirements based on the size of opportunity you’re pursuing.

Use market sizing as a roadmap for strategic decision-making and resource allocation.

What data sources are most valuable for startup market sizing?

Valuable data sources for market sizing include:

- Industry reports: Reports from firms like Gartner, Forrester, or IBISWorld.

- Government databases: Census data, economic indicators, and industry-specific statistics.

- Trade associations: Reports and data from relevant industry associations.

- Market research firms: Specialized reports on specific markets or industries.

- Competitor financial reports: Public filings from publicly traded competitors.

- Customer surveys: Direct feedback from potential or existing customers.

- Academic research: Studies from universities or research institutions.

Combine multiple sources to get a comprehensive and well-rounded view of your market size.

How can startups validate their market size estimates?

To validate market size estimates:

- Cross-reference multiple sources: Compare data from different reputable sources.

- Consult industry experts: Seek opinions from seasoned professionals in your field.

- Use different calculation methods: Compare top-down and bottom-up approaches.

- Conduct customer interviews: Validate assumptions with potential customers.

- Analyze competitor performance: Use competitor data to sanity-check your estimates.

- Pilot testing: Use small-scale market tests to validate assumptions.

- Seek investor feedback: Present your estimates to experienced investors for critique.

The goal is to arrive at a defensible estimate that holds up under scrutiny.

How can startups present market sizing data effectively to stakeholders?

To present market sizing data effectively:

- Use visual aids: Create clear, easy-to-understand charts or graphs.

- Tell a story: Frame your data within a compelling narrative about market opportunity.

- Show your work: Clearly explain your methodology and data sources.

- Provide context: Compare your market size to relevant benchmarks or competitors.

- Address skepticism: Anticipate and proactively address potential doubts or questions.

- Highlight key insights: Focus on the most impactful findings from your analysis.

- Link to strategy: Clearly connect market size data to your business strategy and goals.

The presentation should be clear, credible, and directly tied to your startup’s potential for success.

Effective market sizing

Conducting effective market sizing is a critical skill for startup founders. It provides the foundation for validating your business opportunity, informing your strategy, and attracting investors. Start by clearly defining your market boundaries and understanding the distinction between TAM, SAM, and SOM.

Use a combination of top-down and bottom-up approaches to calculate your market size. The top-down approach starts with the overall market and narrows down to your specific segment, while the bottom-up approach builds from potential customer numbers and average revenue per customer. Using both methods can provide a more robust estimate.

Be thorough in your research

Leverage a variety of data sources including industry reports, government data, and market research. Don’t rely on a single source – cross-reference multiple sources to ensure accuracy.

Avoid common pitfalls like overestimating market size or neglecting to consider competition. Be realistic in your estimates and always be prepared to justify your numbers.

Remember that market sizing is not a one-time exercise. Regularly reassess your estimates, especially before major strategic decisions or funding rounds. As your startup evolves and the market changes, your understanding of your market size should evolve too.

Tell a compelling story

When presenting your market sizing data, focus on telling a compelling story. Use visuals to make the data easy to understand, and always tie your market size back to your startup’s potential for success.

By mastering effective market sizing, you’ll be better equipped to make informed strategic decisions, set realistic goals, and convincingly demonstrate your startup’s potential to investors and other stakeholders.