How Can Startup Founders Create Effective Investor Updates?

Why are regular investor updates crucial for startups?

Regular investor updates are crucial because:

- Trust building: Consistent communication builds trust and credibility with investors.

- Progress demonstration: They showcase your startup’s growth and achievements.

- Alignment maintenance: Updates keep investors aligned with your vision and strategy.

- Support mobilization: They provide opportunities to ask for help or advice from investors.

- Accountability creation: Regular reporting creates a sense of accountability for founders.

- Preparation for future funding: Consistent updates pave the way for smoother future fundraising.

- Relationship strengthening: They help maintain and strengthen relationships with investors.

Effective investor updates can significantly enhance your startup’s relationship with its backers and improve your chances of long-term success.

What key information should startup founders include in investor updates?

Key information to include:

- Financial metrics: Revenue, burn rate, runway, and other relevant financial KPIs.

- Growth metrics: User acquisition, engagement rates, and other growth indicators.

- Major milestones: Significant achievements or important goals reached.

- Challenges and solutions: Honest discussion of obstacles faced and how you’re addressing them.

- Product development: Updates on new features, improvements, or product roadmap.

- Team changes: Any significant hires, departures, or organizational changes.

- Market updates: Relevant industry news or changes in the competitive landscape.

- Upcoming goals: Clear objectives for the next period.

- Ask for help: Specific areas where you need investor support or introductions.

Tailor the content to what’s most relevant for your startup’s stage and your investors’ interests.

How frequently should startups send updates to their investors?

Update frequency guidelines:

- Monthly updates: Ideal for early-stage startups or during periods of rapid change.

- Quarterly updates: Suitable for more established startups with stable operations.

- Annual in-depth reviews: Provide a comprehensive yearly overview in addition to regular updates.

- Major milestone updates: Send additional updates for significant events or achievements.

- Consistent schedule: Whatever frequency you choose, maintain consistency.

- Investor preference: Consider asking your investors how often they prefer updates.

- Stage-dependent: More frequent updates in early stages, potentially decreasing as you stabilize.

The key is to find a balance between keeping investors informed and not overwhelming them with information.

What metrics are most important to highlight in startup investor reports?

Key metrics to highlight:

- Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (LTV)

- Churn rate

- Burn rate and runway

- User growth and engagement metrics

- Conversion rates (e.g., from free to paid users)

- Gross margin

- Customer satisfaction scores (e.g., NPS)

Focus on metrics that best demonstrate your startup’s health, growth, and progress towards key milestones.

How can founders use investor updates to get help and advice?

To leverage updates for support:

- Be specific: Clearly articulate the areas where you need help or advice.

- Provide context: Explain why the help is needed and how it impacts your goals.

- Make it actionable: Suggest concrete ways investors can assist (e.g., introductions, advice on specific issues).

- Follow up individually: Reach out to specific investors for help on relevant topics.

- Highlight expertise needs: Match requests to investors’ specific skills or networks.

- Show appreciation: Always acknowledge and thank investors for their help.

- Report on outcomes: In subsequent updates, share the results of any help or advice received, demonstrating its impact.

By strategically using updates to seek support, you can tap into your investors’ expertise and networks more effectively.

What common mistakes should startups avoid in their investor communications?

Common mistakes to avoid:

- Sugarcoating challenges: Being overly optimistic or hiding problems erodes trust.

- Inconsistent communication: Sporadic or infrequent updates can worry investors.

- Information overload: Providing too much detail can obscure key points.

- Lack of context: Failing to provide background or explain the significance of data.

- Ignoring previous goals: Not addressing progress on previously stated objectives.

- Poor formatting: Disorganized or hard-to-read updates can frustrate investors.

- Failing to ask for help: Missing opportunities to leverage investor expertise and networks.

- Only sharing good news: Investors expect and value honest accounts of challenges too.

Avoid these pitfalls by focusing on clear, honest, and strategic communication.

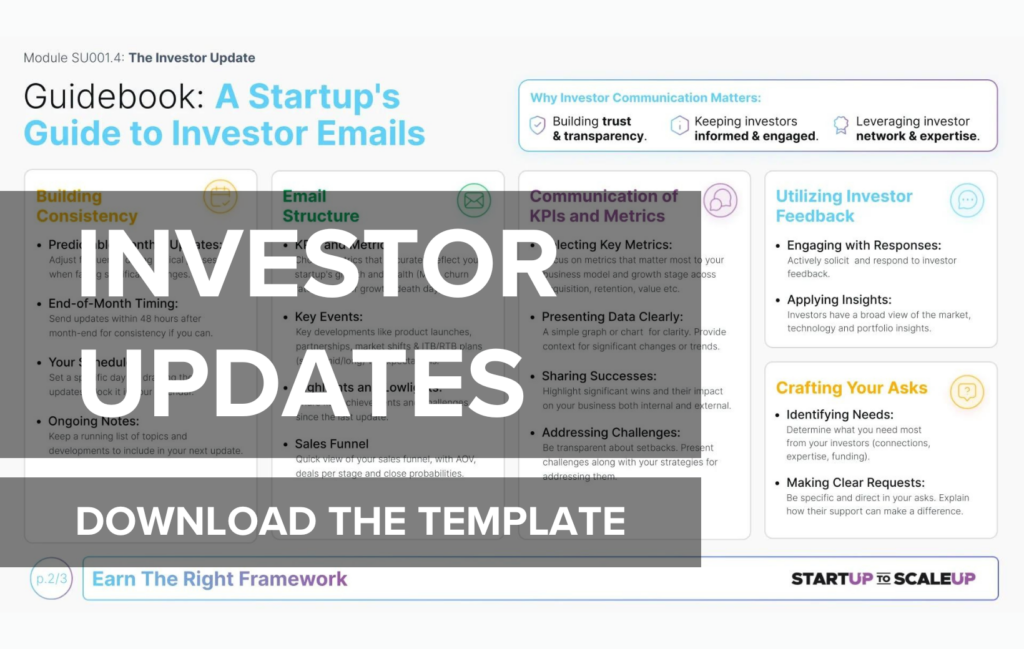

How can startups structure their investor updates for maximum impact?

Effective update structure:

- Executive summary: Start with a brief overview of key points.

- KPI dashboard: Present crucial metrics in an easy-to-digest format.

- Achievements and milestones: Highlight significant accomplishments since the last update.

- Challenges and solutions: Discuss obstacles faced and your approach to overcoming them.

- Product and business development: Share updates on product progress and business growth.

- Financial overview: Provide a concise summary of financial health and projections.

- Goals for next period: Clearly state objectives for the coming weeks or months.

- ‘Ask’ section: Clearly articulate any requests for help or support.

- Appendix: Include additional details or data for interested investors.

Keep the main update concise and scannable, with deeper details available for those who want them.

How can founders ensure their investor updates are actionable?

To make updates actionable:

- Set clear expectations: State what you need from investors upfront.

- Prioritize requests: Focus on the most critical areas where investor help can make a difference.

- Be specific: Instead of general requests, ask for specific introductions or advice.

- Provide context: Explain why each request is important and how it aligns with your goals.

- Make it easy to help: Provide templates or draft emails for introductions or referrals.

- Follow up individually: Reach out to specific investors for targeted support.

- Create urgency: When appropriate, include deadlines or time-sensitive opportunities.

- Show appreciation: Always acknowledge help received and report on its impact.

The goal is to make it as easy as possible for investors to provide meaningful support.

How can startups use data visualization in their investor updates?

Effective data visualization:

- Use charts and graphs: Present key metrics visually for quick understanding.

- Create a KPI dashboard: Summarize crucial metrics in a single, easy-to-read visual.

- Show trends: Use line graphs to illustrate progress over time.

- Comparative visuals: Use bar charts to compare performance against goals or competitors.

- Infographics: Summarize complex information in visually appealing infographics.

- Color coding: Use colors consistently to highlight positive or negative trends.

- Interactive elements: For digital updates, consider interactive charts that allow deeper exploration.

- Annotate visuals: Add brief explanations to help interpret the data.

Well-designed visuals can make your updates more engaging and help investors quickly grasp key information.

Creating effective investor updates is a crucial skill for startup founders. Start by establishing a consistent schedule for your updates – monthly or quarterly is typical, depending on your stage and investor preferences. Consistency builds trust and keeps investors engaged with your progress.

Transparency is key

When crafting your updates, focus on providing a clear, honest picture of your startup’s health and progress. Include key metrics that demonstrate growth and challenges, major milestones achieved, and goals for the upcoming period. Be transparent about both successes and obstacles – investors appreciate honesty and want to see how you’re navigating challenges.

Structure your updates for easy reading. Start with an executive summary highlighting key points, followed by more detailed sections. Use data visualization to make key metrics and trends easily digestible. Always include a section on how investors can help, whether that’s through introductions, advice, or other support.

More than just reporting

Remember that investor updates aren’t just about reporting – they’re an opportunity to strengthen relationships and leverage your investors’ expertise and networks. Be specific about the help you need and make it easy for investors to provide support.

Avoid common pitfalls like sugarcoating challenges, providing inconsistent updates, or overwhelming investors with too much information. Focus on clear, concise communication that provides genuine value to your investors.

By mastering the art of effective investor updates, you can build stronger relationships with your backers, keep them aligned with your vision, and increase your chances of securing support and future funding. Remember, your investors are partners in your success – keep them informed and engaged, and they can become powerful allies in your startup journey.