Join 140,000+ Startup Founders Getting theTactical Edge

Every Sunday, I share exclusive insights, frameworks, and strategies that helped me build and exit 3 startups. No fluff. Just actionable advice to help you win.

Get instant access to the 50-Step Founder Playbook downloaded over 1M times

READ BY FOUNDERS FROM:

James Sinclair

Founder Coach

90% of Startups Fail.Not because founders don't work hard, but because theybuild products nobody wants.

Startup Frameworks

Proven frameworks to help you validate your idea, find product-market fit, and scale your business.

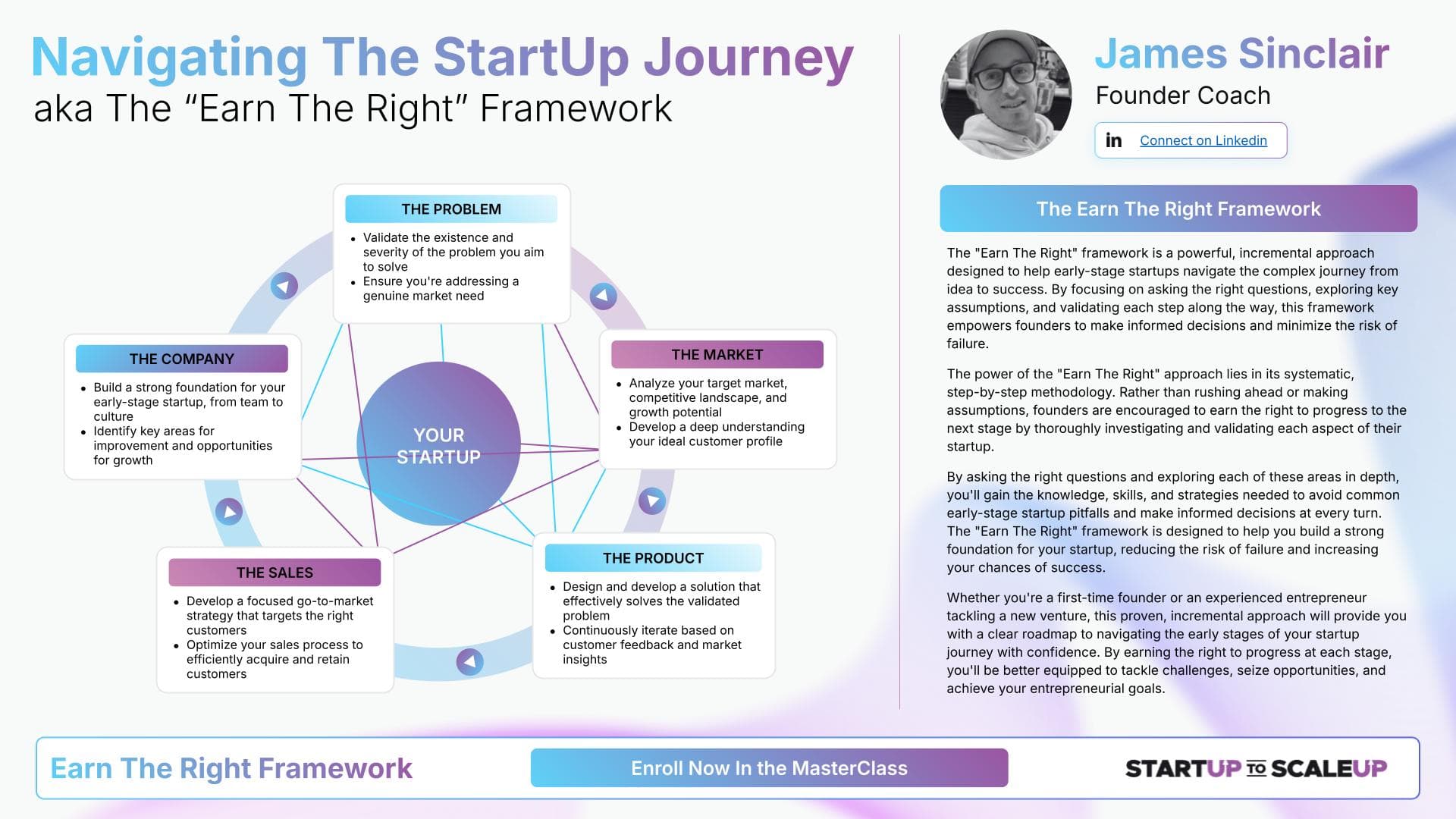

Earn The Right

This module shows you how to reframe startup progress as a series of earned rights. You'll learn to self-diagnose your stage, anchor decisions in proof, and accelerate execution without skipping foundations.

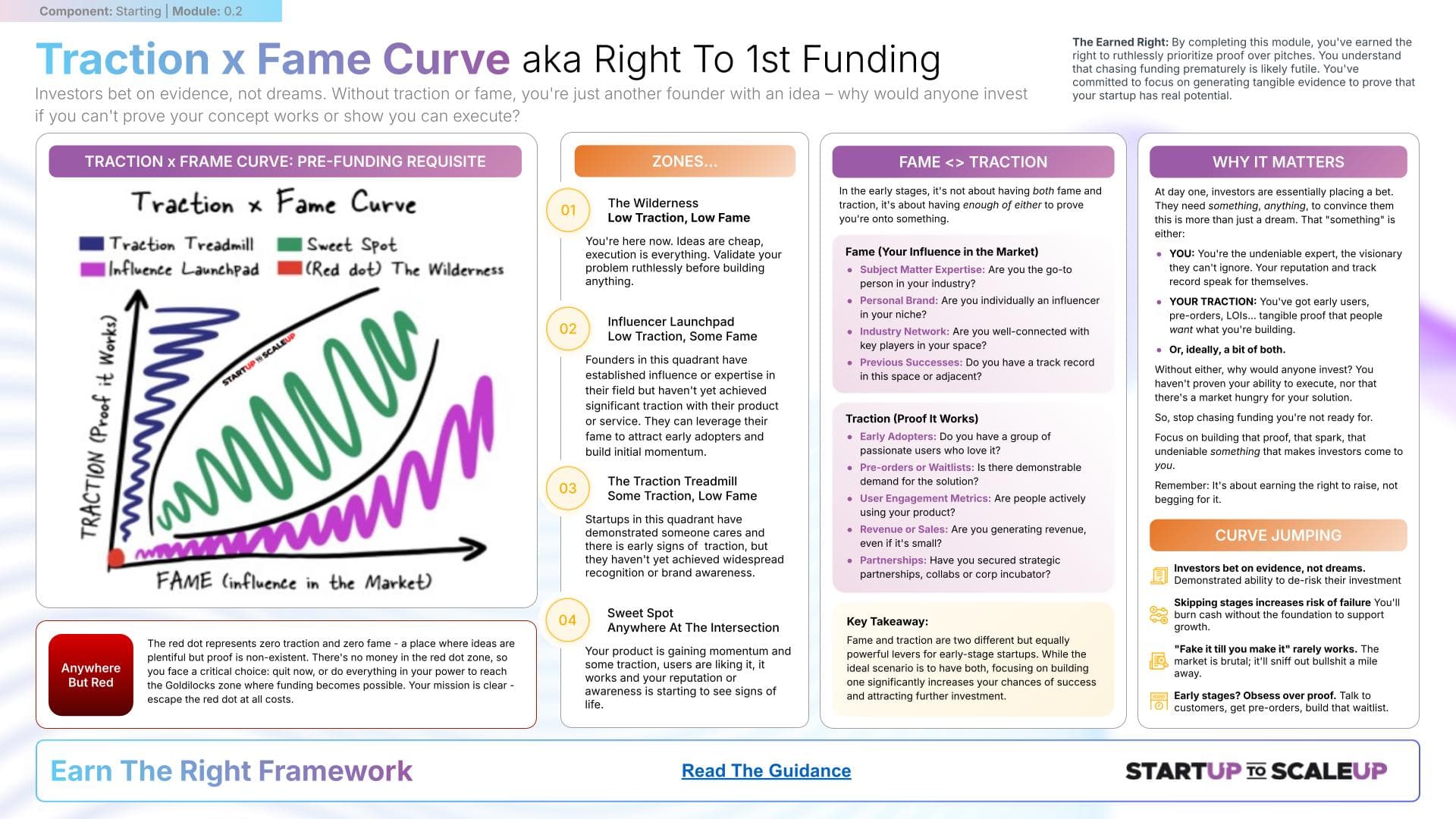

There Is No Money

There Is No Money teaches you how to earn the right to raise capital — not with a deck, but with evidence. You’ll learn how to use traction or credibility to escape the 'Red Dot' and become fundable. This module gives you a clear way to self-diagnose, frame early signals, and build momentum that investors can’t ignore.

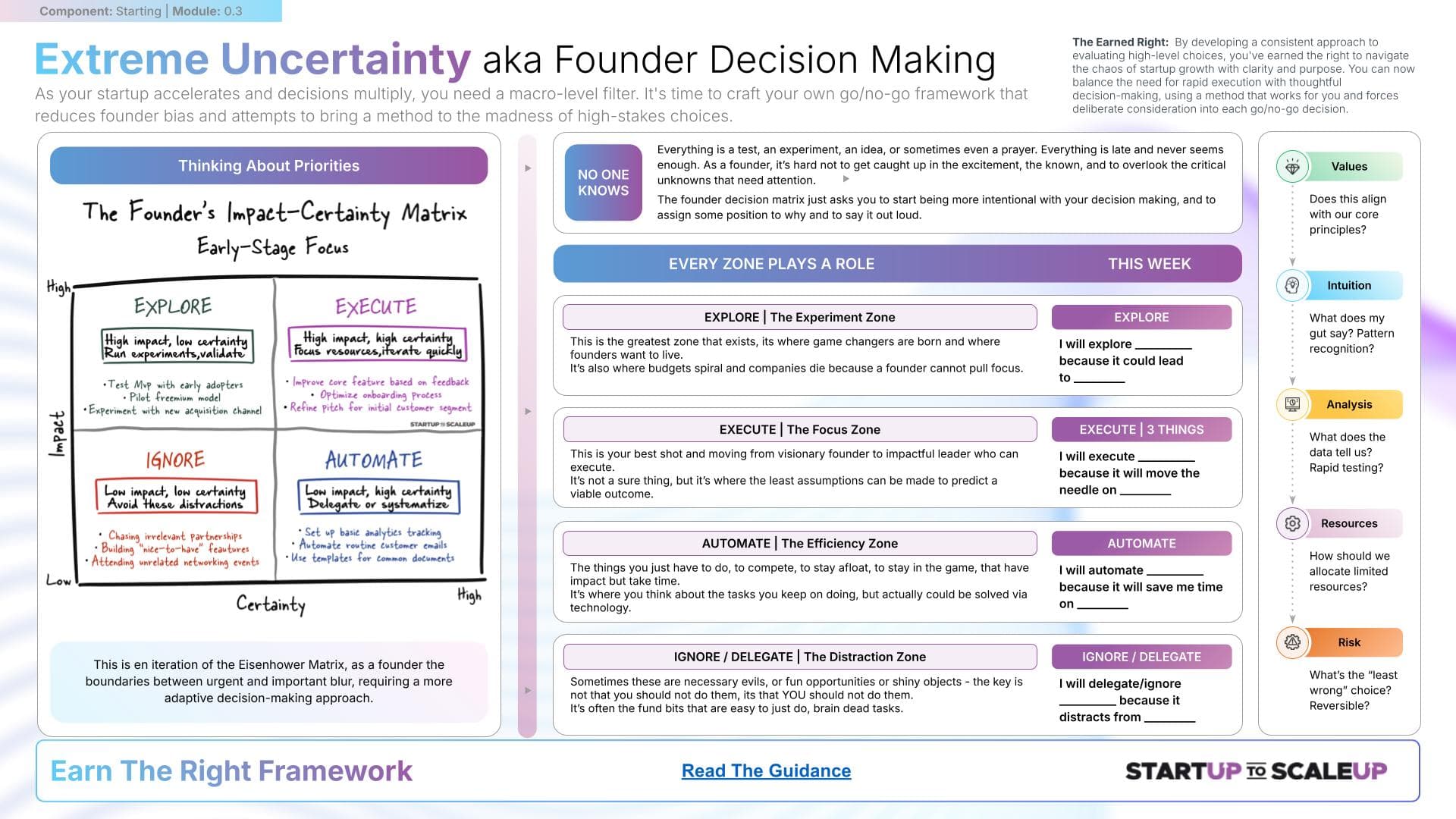

Extreme Uncertainty

This module shows you how to make faster, smarter calls in the face of unknowns. You'll learn how to prioritize actions based on risk, evidence, and resources — using a battle-tested decision matrix designed for early-stage chaos.

The Founder's Playbook

The complete guide to building a successful startup from scratch, based on real-world experience.

Starting A StartUp: Build Something People Want

Whether you're a first-time founder or an experienced entrepreneur tackling a new venture, this proven, incremental approach will provide you with a clear roadmap to navigating the early stages of your startup journey with confidence.

By earning the right to progress at each stage, you'll be better equipped to tackle challenges, seize opportunities, and achieve your entrepreneurial goals.

Practical Frameworks

50+ battle-tested frameworks to validate your idea, find product-market fit, and scale your business.

Real-World Examples

Case studies from successful startups that show you exactly how to apply these frameworks in practice.

Actionable Advice

Step-by-step guidance on how to implement each framework, with templates and worksheets included.

James Sinclair

Founder Coach

The difference between successful founders and everyone else isn'tintelligence or luckit's the ability to validate ideas before building them.

Weekly Insights

Join 140,000+ founders getting exclusive strategies, frameworks, and founder stories every Sunday.

Clarity Before Strategy: Seven Questions Every Founder Must Answer

Strategy is the application of clarity over time. Before your 2026 roadmap, answer seven fundamental questions about your business. If clarity is vague, strategy is by default vague.

December Strategy: Four Weeks to Do Nine Weeks of Work

December is the most valuable month of the year. Learn how to close what can close, send your end-of-year update, align your team on Q1 priorities, show strategic gratitude, and turn your Q4 into Q1 advantage. Wanting it different doesn't make it different.

Founder Beliefs: First Belief - From 'I Can Do This' to the Fatal Ceiling

The very first belief every founder holds is 'I can do this,' unearned but required. Learn the taxonomy of founder beliefs, from Required to Fatal to Fraud, why 'I'm the only one who can do this' becomes your ceiling, and how to evolve past the founding version of yourself.

Latest Posts

Practical advice and insights to help you navigate your startup journey.

Should a Startup Have Two CEOs? No. (Sometimes!)

Why co-CEO setups almost always fail, how founder friction compounds, and what to do if you’re already stuck.

StartUp Founder Loneliness

The emotional cost of building something from nothing—why it's normal, and what to do about it.

StartUp OODA Loop

How the fastest startups outmaneuver giants using fighter pilot decision-making.

Founder Resources

Essential guides to help you avoid common pitfalls and build something that actually works.

A tactical, no-fluff guide to identifying zombie startups, diagnosing the hidden rot, and executing a revive-or-kill play within 90 days.

James Sinclair

I'm James Sinclair, a 3x Exited Founder who now spends every day working with remarkable entrepreneurs at all stages.

I've helped hundreds of founders navigate the complex journey from idea to successful startup. My frameworks have been downloaded over 1 million times, and my weekly newsletter reaches over 140,000 founders around the world.

Join 140,000+ Founders

Get weekly insights on building and scaling startups. No fluff, just actionable strategies.

Get instant access to the 50-Step Founder Playbook downloaded over 1M times